The Economic Coordination Committee (ECC) of Pakistan’s Cabinet approved a new vehicle import framework on April 27, 2024, tightening regulations and aiming to regulate the import schemes effectively. This decision is set to impact Pakistan’s automobile sector and broader economic landscape significantly.

ECC Approves Revised Vehicle Import Framework

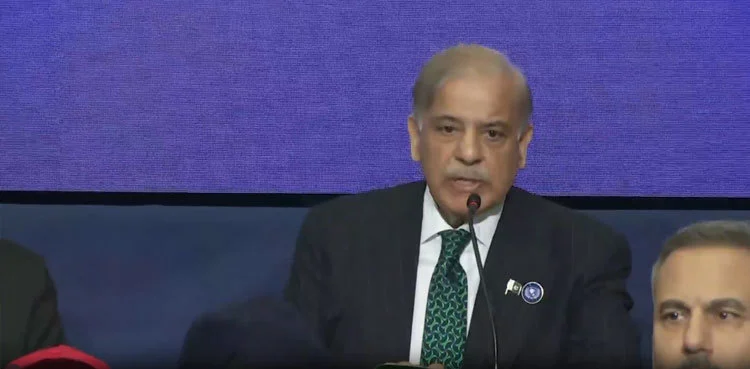

In a move to streamline the automobile import sector, the ECC introduced a comprehensive vehicle import policy at its meeting held in Islamabad. The new framework includes stricter conditions on import eligibility, tax structures, and enforcement of compliance to curb misuse of existing schemes.

A senior official stated, “The revised vehicle import framework will enhance regulatory oversight, ensuring imported vehicles meet the country’s economic and environmental goals.” The policy adjustment is expected to align import volumes with market realities and reduce pressure on Pakistan’s foreign exchange reserves.

Background and Rationale

Pakistan’s automobile industry and import sector have faced challenges with unregulated imports and misuse of tax concessions. The government previously allowed multiple schemes, which, according to economic experts, led to distorted market dynamics and revenue losses. The new import framework aims to close these loopholes while supporting legitimate importers.

This development comes amidst ongoing efforts to stabilize the Pakistan economy and improve the trade balance. The policy adjustment is a part of broader tax reforms Pakistan has initiated targeting various sectors to increase revenue collection and economic transparency.

Key Highlights of the New Vehicle Import Framework

- Stricter eligibility criteria for personal and commercial vehicle imports.

- Enhanced verification processes to prevent fraudulent use of schemes.

- Revised customs duties and taxes aligned with government revenue targets.

- Monitoring mechanisms involving provincial and federal agencies to ensure compliance.

- Integration with Pakistan Customs systems for real-time tracking of imported vehicles.

Impact on Pakistan’s Automobile Sector and Economy

The new policy is likely to bring stability to vehicle pricing by reducing grey imports and discouraging smuggling. Analysts expect positive outcomes for local manufacturers due to reduced unfair competition from imported vehicles. Moreover, tightening import rules aligns with government strategies to support domestic production and reduce reliance on foreign automobile imports.

This policy change also factors into ongoing travel policy updates and aviation news, where transport regulations continue to evolve under federal oversight. By better regulating imports, Pakistan aims to sustain economic growth while addressing security concerns linked with unregistered vehicles.

Official Statements and Future Outlook

In an official statement, the Ministry of Commerce emphasized, “The new vehicle import rules reflect Pakistan’s commitment to transparent, fair trade practices, and fiscal discipline. We expect positive contributions towards the national economy and increased regulatory compliance.”

Looking ahead, stakeholders will monitor the implementation phase closely to ensure the framework’s effectiveness in curbing illicit import activities, supporting tax reforms Pakistan, and strengthening the automobile sector.

The new vehicle import framework approved by the ECC marks a significant step towards strengthening Pakistan’s economic policies and regulating the automobile import market effectively. Implementation updates are expected in the coming weeks.

Don’t miss a moment—catch all the latest news only on Faiz.tv.